This new Lehmans scandal sums up two of the biggest problems that we – the voting, taxpaying general public – still have with the banks, almost two years after they blew up and we bailed them out. First, the operation of capital markets is international, but the legislative regimes why try to control it are local. Financial institutions are constantly on the alert for ways in which they can exploit differences between jurisdictions – the Repo 105 is merely a glaring public example of something which goes on all the time. Even Sarbanes-Oxley, the all-time monster crackdown on tricky accounting by the world’s dominant economic power, turned out to be wholly ineffective. Any action on banks has to be coordinated and international, or it is worthless. Unfortunately, that coordination is much easier to call for than to achieve. This is on the main reasons why we have as yet had no effective action to restrain the banks.

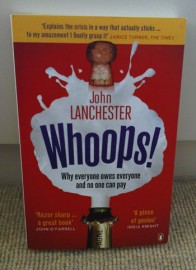

From “Whoops! Why everyone owes everyone and no one can pay”, by John Lanchester (Penguin, 2010)